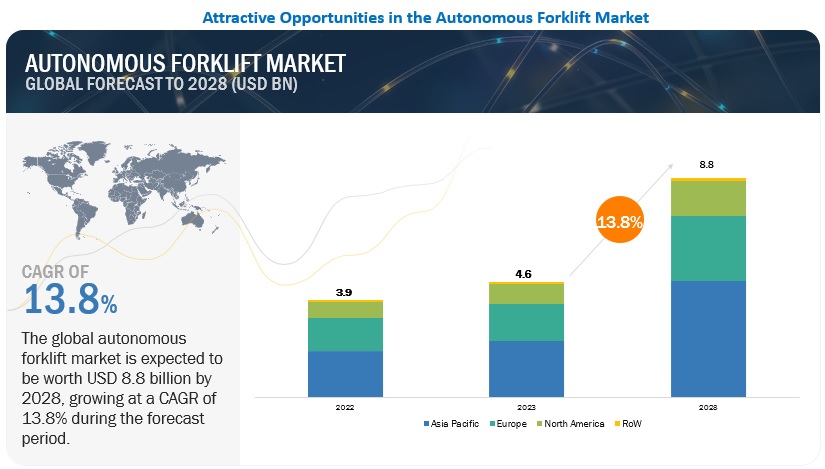

The Autonomous Forklift Market size is projected to grow from USD 4.6 billion in 2023 to USD 8.8 billion by 2028, at a CAGR of 13.8% from 2023 to 2028.

The growth of the autonomous forklift market is influenced by factors such as rising complexities for product handling, rising need for smart logistics, good return on investment, better space utilization, and growing consumerism through online platforms. Therefore, the autonomous forklift market is expected to witness significant growth in the future.

— E-commerce is predicted to be the fastest-growing industry for autonomous forklifts.

The demand for automated fulfillment centers in the e-commerce sector has increased due to the rapidly shifting customer demands, growing preference for online shopping, surging demand for faster delivery times, and intensifying competition among online retailing companies. China, the US, and the UK accounted largest market share in 2021 as China held ~50-55% of total e-commerce retail sales followed by the US with ~18-22% and the UK with ~4-6% in 2021.

Growing sales of e-commerce in many countries will require building multiple warehouses to store and deliver goods in less time. To increase the efficiency and productivity of these warehouses, different automated material handling equipment is required. Autonomous forklifts play crucial roles in e-commerce warehouses for loading and unloading goods, and transportation of pallets from one place to another. It can streamline warehouse operations, reduce product delivery time, reduce labor costs, improve efficiency, and enhance safety. Below 5-ton autonomous forklifts are majorly preferred forklifts because the average pallet size in an e-commerce warehouse is 1-2.5 tons. Global companies are adopting various growth strategies to boost their business.

For instance, Seegrid Corporation declared in March 2021 that it is looking for acquisitions to keep up with the rapidly expanding e-commerce market as manufacturers and retailers rush to automate their facilities to meet demand. Kion Group AG (Germany), Toyota Material Handling (Japan), and Jungheinrich AG (Germany) are the major suppliers who offer below 5-ton autonomous forklifts for e-commerce warehouses.

— Material Handling applications are expected to be the largest growing segment for autonomous forklifts.

Material handling equipment is predicted to be the largest application market for autonomous forklifts. Material handling is a fundamental component of the movement of goods, whether they are being used indoors or outdoors, in enclosed warehouses or open fields. As a result of its use across all industries, the material handling application segment is expected to grow at the fastest rate during the forecast period.

In addition, it is anticipated that the warehousing application segment will have the second-largest market share during the projected period, right behind the material handling application segment. The need for stocking and contactless, quick delivery of goods has significantly increased after the pandemic. Autonomous forklifts and other automated material-handling equipment becomes significant in warehouse material-handling operations. Additionally, during the anticipated period, the demand for autonomous forklifts in warehouse applications will be fueled by growing product differentiation and shrinking pallet sizes.

— Europe accounted for the second largest market share in the autonomous forklift market in 2023.

Europe is the second largest market for the autonomous forklift market from 2023-2028. Traditionally, Europe has been the region with the advanced warehousing and material handling automation implementation. High labor costs, a lack of available space, and strict worker safety regulations are some of the main causes of the European material handling ecosystem’s high adoption of automation technologies.

The EN 1525 and EN 1526 regulations, which deal with automated technologies, establish safety requirements for regional AGVs. This region’s adoption of AGVs and related automated material handling equipment is anticipated to benefit from these regulations. Automated material handling warehouse automation systems were first used in Europe. The market is expanding due to things like strict worker safety regulations, high wages, and rising real estate prices. Brexit has made localized distribution centers more necessary. For example, post-Brexit warehouse availability has been at an all-time low, between 15% and 2% in some locations. Due to an increase in e-commerce sales, there is also a greater need for prompt order fulfillment.

Also, the pharmaceutical industry would drive the adoption of autonomous forklifts in Europe. Autonomous forklifts in the pharmaceutical segment are used for the applications such as the transportation of raw materials & finished goods, inventory management through forklift scanners & sensors, quality control using autonomous forklift cameras and sensors, and environment monitoring. Most pharmaceutical companies use below 5-ton autonomous forklifts for floor-floor operations. Thus, rising applications of autonomous forklifts in the pharmaceutical segment with increased efficiency and reduced labor cost will drive the demand for autonomous forklifts.

— Key Market Players

The autonomous forklift market is dominated by several global and regional players. Some of the manufacturers in the autonomous forklift market are Toyota Industries Corporation (Japan), Hyundai Construction Equipment Co Ltd (South Korea), Kion Group AG (Germany), Mitsubishi Logisnext Co Ltd (Japan), Jungheinrich AG (Germany), Hyster-Yale Materials Handling (US), Agilox Services GMBH (Austria), Anhui Heli Co Ltd (China), Hangcha Group Co. Ltd (China) Multiway Robotics (Shenzhen) Company (China), and Scott Automation (China).

From the information mentioned above. There are still many other technologies that will help make smart cars even more efficient and can make everyone’s work in the warehouse more efficient than competitors which you can consult and contact for additional information From our team

Source: linkedin

Picture: freepik & marketsMarketsand